By Richard Lyall

The federal government’s decision to remove the five-per-cent GST on construction of new rental apartment buildings has come late in the game. Still, it is a good first step to tackle the housing supply crisis.

The move—along with the proclamation by the Ontario government that it intends to follow suit and eliminate the eight-per-cent HST—will spur much-needed construction of more purpose-built rentals (PBRs).

However, much more work remains to right the ship, especially at the municipal level, and eliminate systemic problems that continue to slow down production of housing. Hopefully, the recent moves by the feds and the province will similarly embolden the municipalities to speed up approvals.

For years, RESCON has been calling on the feds to exempt or rebate the collection of the sales taxes on PBRs. More recently, we also asked for a significant increase in transfer payments to municipalities from federal taxes collected from new housing construction to facilitate reduced infrastructure cost pressures on cities and towns which have limited funding tools.

Proposed changes such as these would certainly go a long way towards getting shovels in the ground on apartment, condo, and housing projects.

We haven’t been building enough PBRs to accommodate our growing population.

The GTA alone needs more than 300,000 new rental homes in the next decade, according to an earlier report released by the Building Industry and Land Development Association, the Federation of Rental-housing Providers of Ontario (FRPO), Urbanation Inc. and Finnegan Marshall Inc. The rental housing deficit in the GTA is expected to double in the next 10 years to 177,000 units.

PBR supply growth will need to rise from a projected 47,000 units to 124,000 units in the next decade to keep up with demand. The report says this figure should be considered a minimum and realistic target, meaning rental construction starts will need to more than double their current pace.

As a result, rents have climbed. John Pasalis, president of Realosophy Realty, recently reported that the average cost for a condo rental in Toronto was $1,866 in 2016 but climbed to $2,786 by June 2023.

The recent changes announced by the feds were long overdue. In the 2016 election, the Liberals promised to waive the GST on new capital investments in affordable rental housing. But in 2017, the government reversed course, claiming research showed there are better ways to boost supply.

The changes were needed now more than ever as residential builders have been hit with a perfect storm of inflation, interest rate hikes, material and labour supply shortages, and rising fees and development charges.

According to a backgrounder issued by the Ministry of Finance, the changes being introduced by the feds will result in an “enhanced GST rental rebate” being applied to new purpose-built housing, such as apartment buildings, student housing and senior residences built for long-term rental accommodation, that begin construction on or after Sept. 14, 2023, and on or before Dec. 31, 2030. Under the new rules, the developer of the project must complete construction by Dec. 31, 2035.

Before the change, the feds provided a 36-per-cent rebate on the taxes for construction of rental units with a fair market value of $350,000 to $450,000. The threshold is being removed and the rebate is being hiked to 100 per cent.

We have been advocating for bold and decisive action to enable builders to build more housing and rental units.

Hopefully, municipalities will now jump on the bandwagon.

Richard Lyall is president of the Residential Construction Council of Ontario (RESCON).

Richard Lyall is president of the Residential Construction Council of Ontario (RESCON).

[This article originally appeared in the November/December 2023 edition of ReNew Canada]

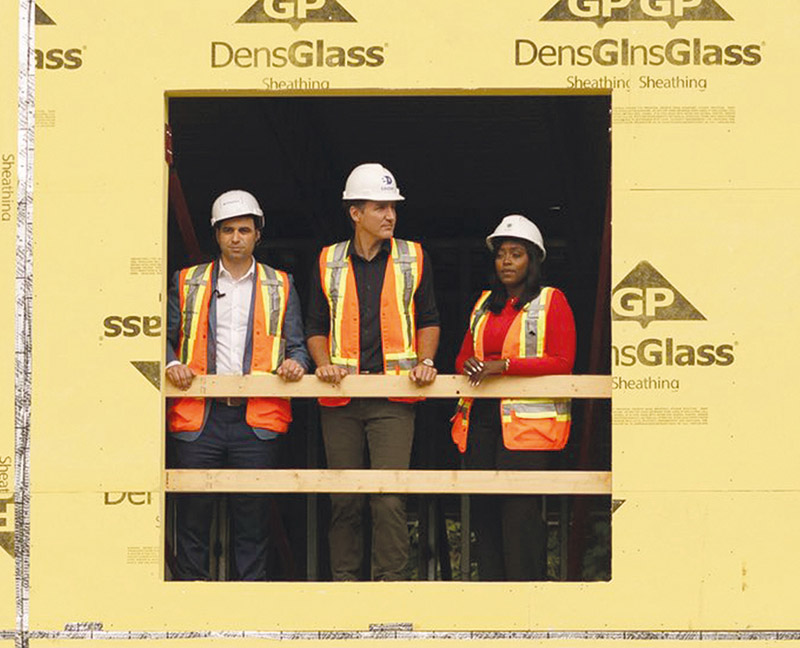

Featured image: (Government of Canada)