By Jordan Thomson

KPMG in Canada in collaboration with the Canadian Construction Association (CCA) surveyed construction companies across Canada in 2020 and presented a Digital Maturity Assessment Tool to help advance the industry’s digital transformation. In 2023, KPMG relaunched an updated version of the survey, interviewing 275 Canadian companies to gauge the progress that the industry has made in adopting new technologies and transforming the way their organizations operate. The survey’s respondents represented all facets of the Canadian construction industry including owners, general contractors, suppliers, subcontractors, engineers, and architects.

When KPMG conducted its 2020 survey, digital and technological maturity in the construction industry was “fairly low.” The 2023 survey reveals the industry has made headway but more needs to be done. COVID-19 hastened their digital journeys: Over two thirds (67 per cent) of respondents say the pandemic spurred new investment in new technologies for their business.

Industry Outlook

The industry has tremendous growth potential across the industrial, commercial, institutional, and civil construction sectors in part fueled by housing demand, government investments in infrastructure, and the transition to the green economy. However, the industry is divided in its outlook for the next five years despite the anticipated need. While 42 per cent of respondents are significantly or somewhat more optimistic about the sector’s five-year outlook, a third are significantly or somewhat more pessimistic. Owners and suppliers have a more optimistic view of the future than general contractors, subcontractors, and consultants (architects, engineers, etc.) The high level of optimism with owners is important to note, as they represent the first link in the construction value chain. Their optimism suggests continued investment in projects will flow to the rest of the industry.

In the near term, the construction industry is buckling in for a possible recession. Over two-thirds (67 per cent) of construction companies expect an economic downturn in the next 12 months. Nearly seven in 10 respondents who expect a recession are currently either accelerating their digital transformation strategies or staying the course on their digitalization timetables. Fewer than a third (31 per cent) are pausing or reprioritizing their digital plans largely to cut their operating expenses and alleviate economic stresses.

Hitting the labour wall

Like many other industries, the construction industry is facing a labour shortage, exacerbated by the pandemic-induced early retirement of older workers. Contractors across the country are experiencing a significant labour crunch, with 90 per cent reporting shortages. Technology offers ways for companies to weather the scarcity of labour, with 86 per cent believing that project management tools and digital technologies can enhance labour effectiveness. Additionally, 89 per cent of respondents are considering alternative construction approaches including prefabrication, modularization, and innovative tools and machinery to improve efficiency.

Technology adoption: What’s in your toolkit?

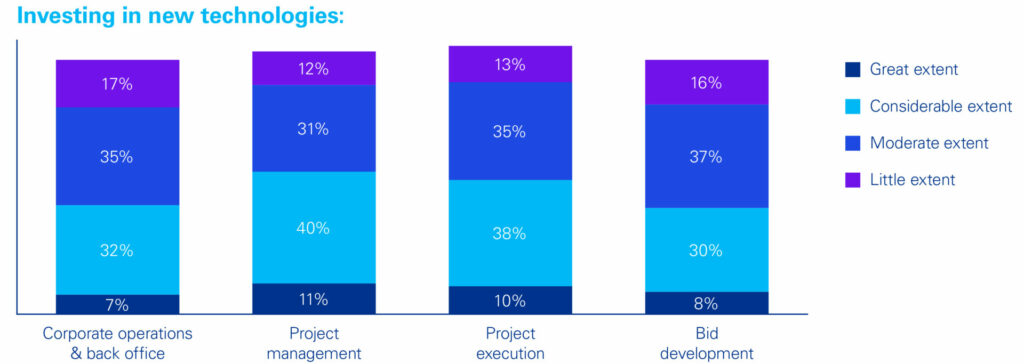

Where are construction companies putting their digital investment dollars?

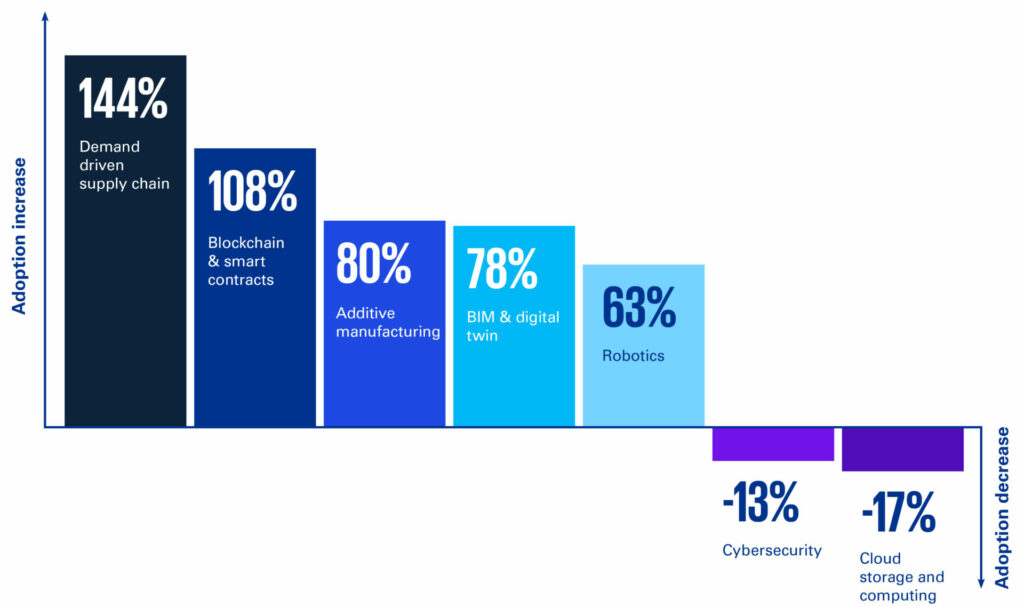

Technology Adoption: 2020 to Today

Big data

Big data and analytics can help companies better analyze and understand project performance and enable targeted actions to reduce project costs and timelines, identify safety issues and material wastage, improve sustainability, and increase efficiency. Predictive analytics, machine learning (ML) and artificial intelligence (AI), can also help owners and contractors to better analyze historical material and equipment costs, labour productivity, schedule performance and other project variables to evaluate a project’s risk profile and develop more accurate estimates of project cost and timelines.

Big data has made a “great or considerable” positive impact for 40 per cent of the companies currently using it. However, this leaves 60 per cent of companies where there is opportunity for improvement. This also begs the question as to the quality of the data that’s collected, and whether a wholistic big data strategy has been developed or implemented.

Demand-driven supply chain

Demand-driven supply chain (DDSC) integrates links along the supply chain to anticipate demand and enable faster and more cost-effective delivery of materials and services. While DDSC has been leveraged for years in the manufacturing industry, the pandemic highlighted the importance of active supply chain management in the construction sector.

Investments in new technologies intersect with DDSC to enhance supply chain management accuracy and effectiveness.

Building information modelling and digital twins

BIM uses 3D modelling to digitally render construction designs and analyze construction phases and site logistics, increasing both efficiency and productivity by providing a central repository for project data, providing critical project data spanning design criteria, materials, construction, cost, and warranty and operation documentation.

Over half of respondents (62 per cent) say they are experienced to a “moderate” or “great extent” with BIM and digital twin technologies and their application in project delivery.

Robotics and Automation

When asked the extent to which they are using robotics —like drones, exoskeletons, collaborative robotics, etc.—over half of companies (52 per cent) say to a “moderate” or “great extent”.

While the survey shows an increasing focus on robotics and automation, we believe that companies are primarily investing in lower-cost technologies, like drones. Based on the survey findings, the key business case for robotics is worker health and safety followed by schedule efficiency and productivity. This is aligned with the manufacturing sector, where automotive companies have already invested in tools like exoskeletons to improve workplace safety.

Blockchain and smart contracts

Almost six in 10 companies plan to introduce or are in discussions to implement smart contracts built on blockchain technology, finds the research. The objective is to improve transparency, accountability, and traceability. It’s a single source of truth covering all aspects of a construction project, and as such, can also deter fraud by eliminating suspicious and duplicate transactions. Information on purchased materials can be visible on the blockchain, including production and quality certificates.

Internet of things sensors

Canadian construction companies have various reasons for investing in wearables and Internet of things (IoT) sensors, including to improve productivity, planning, and estimating, sustainability or health and safety. The survey finds that only 56 per cent have invested in IoT to a “moderate” or “great extent.”

IoT sensors can cover a broad array of attributes including water, temperature, air quality and particulate counts to fire risks, the structural integrity of a building, monitoring proper curing and quality of concrete and more.

Accordingly, IoT sensors offer an interesting value proposition to insurance companies that can use sensors to better understand and mitigate risk (like water leaks) by requesting that construction companies deploy IoT technology to detect, mitigate and control risks and thereby reducing project risk and potential insurance claims.

Cyber risk management

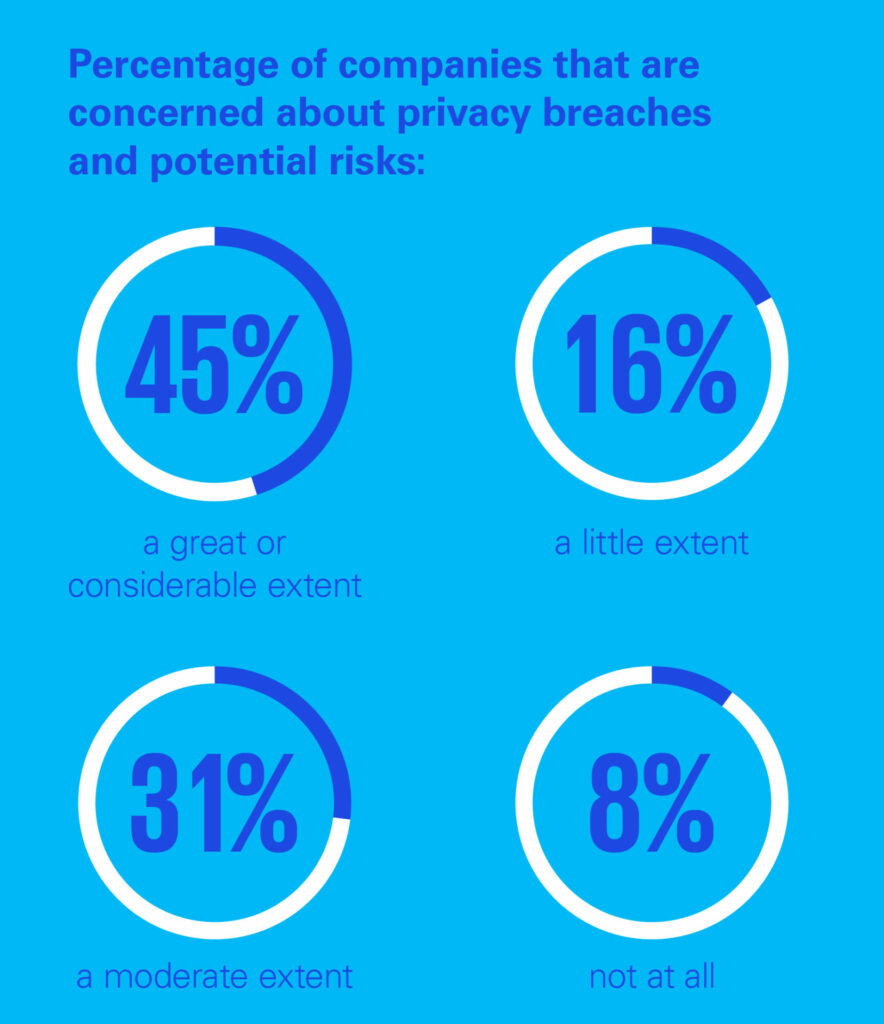

The transition to a more digital space does, however, come with risks. From ransomware to spear phishing and distributed denial of service (DDoS) attacks, cyberattacks in Canada are on the rise. No industry is immune.

Yet, fewer than four in 10 companies (38 per cent) have implemented cybersecurity tools and technologies, finds KPMG’s survey. Only about a third (32 per cent) have definitive plans to implement cybersecurity technologies over the next three years. The remaining 13 per cent admit they have no plans to implement cybersecurity tools. No wonder then that over half (56 per cent) of those surveyed aren’t confident that their IT world is secure.

Percentage of companies that are concerned about privacy breaches and potential risks:

As companies leverage technologies—such as robotics to assist in builds, drones to monitor worksites, and sensors and connected devices to operate smart buildings—they generate, collect, and store vast quantities of data. Cybercriminals are looking for vulnerabilities or ways in to steal personnel, account or financial records, architectural and engineering designs, intellectual property data, or confidential/sensitive project information, or to gain control of critical infrastructure.

Getting the right people at the table

A successful digital strategy starts with board and executive sponsorship. But only 44 per cent of the companies surveyed say that top management assigns a “great” or “considerable” significance to digital transformation.

Department heads—those closest to the organization’s needs and limitations—will need to play a larger role in guiding their organization’s digital maturity by reviewing their workforce capabilities 77 per cent of companies say that digital transformation will require hiring new talent within their organization to a “moderate” or “great” extent.

In KPMG’s 2020 report, they posed the question, ‘Can you afford to wait?’ The ensuing three years proved that companies can’t afford to wait. The industry now recognizes that they must modernize or be left behind. “Technology can help the construction industry address Canada’s housing and infrastructure challenges,” says Tom Rothfischer, partner, and national industry leader, Building, Construction, and Real Estate, KPMG in Canada. “Digital tools, if used smartly, save time and money, reduce waste, and improve worker safety and productivity. In short, they help get projects done on time or ahead of schedule and on budget.” The next three to five years could well be a ‘make or break’ time frame for many companies.

KPMG in Canada used the Methodify online research platform owned by Sago, a leading global data collection and research services company, to interview 250 Canadian construction companies from February 6 to March 17, 2023, on their Asking Canadians B2B panel. An additional 25 companies were surveyed by KPMG from November 2022 through March 2023.

Jordan Thomson is construction lead with KPMG in Canada.

[This article originally appeared in the September/October 2023 edition of ReNew Canada]

Featured image: New research from KPMG in Canada found that digital technology can help address the backlog of Canadian housing and infrastructure projects bogged down by unprecedented demand and a chronic shortage of skilled labour. (Getty Images)