The Canada Infrastructure Bank (CIB) introduced its Infrastructure for Housing Initiative (IHI), designed to help address the infrastructure constraints which are limiting new housing construction.

The CIB has developed a financing tool for municipalities and Indigenous communities which are committed to building new infrastructure in support of new housing supply. Industry and municipal stakeholders have emphasized that more municipal infrastructure investment is a prerequisite to building more housing. The CIB’s new lending product is designed to unlock new housing in a very targeted and specific way.

“Through our new lending initiative, we are committed to working with municipalities to unlock new housing developments. The housing challenge in Canada requires innovative thinking, new partnerships and a variety of financing supports to make progress. We are pleased to have already advanced financing to a number of projects which will spur new housing such as district energy expansion, transit lines, broadband networks and water treatment facilities,” said Ehren Cory, CEO, Canada Infrastructure Bank.

As an impact investor, CIB is looking to partner on eligible projects which are expected to be primarily new, large-scale enabling infrastructure, including:

- water: water, wastewater, stormwater, conveyance

- transportation: roads, bridges and the accompanying civil work

- transit: electric buses, light-rail transit, stations and terminals

- clean power: district energy, electricity distribution, storage

The initiative leverages the CIB’s existing capital across the CIB’s existing priority sectors.

The CIB’s lending product also helps municipalities and Indigenous communities by sharing in risks related to the timing of community growth, linking repayments to the number of housing units expected to increase as housing growth materializes. This allows them to go faster and build bigger today in anticipation of future growth.

Other notable benefits of the IHI include:

- accelerating infrastructure while limiting the requirement for future tax and rate increases

- providing access to credit and competitive interest rates for smaller municipalities which may not have access to capital markets or a provincial borrowing program

- municipally-owned corporations would also be eligible borrowers

“With the CIB’s new Infrastructure for Housing Initiative, communities across the country will have access to financing that will help build the infrastructure needed to increase housing supply. This is a significant lever communities can now access to enable local investments in critical infrastructure from roads to public transit and water treatment systems. The CIB’s innovative approach toward addressing the housing challenge will help municipalities and Indigenous communities with the development of complete, inclusive and sustainable communities with affordable and accessible housing,” said Sean Fraser, Minister of Housing, infrastructure and Communities.

IHI will work alongside existing federal supports for housing as part of the broader federal approach to address the housing shortage. The CIB’s existing investments are already making an impact in the housing market. As recently announced, CIB committed up to $140 million to the City of Brandon and the Red-Seine-Rat water cooperative located in southeastern Manitoba, which is expected to unlock development of up to 15,000 housing units in these growing communities. Other investment examples which support housing include Lulu Island District Energy, Markham District Energy and the Port Stalashen Wastewater Treatment project.

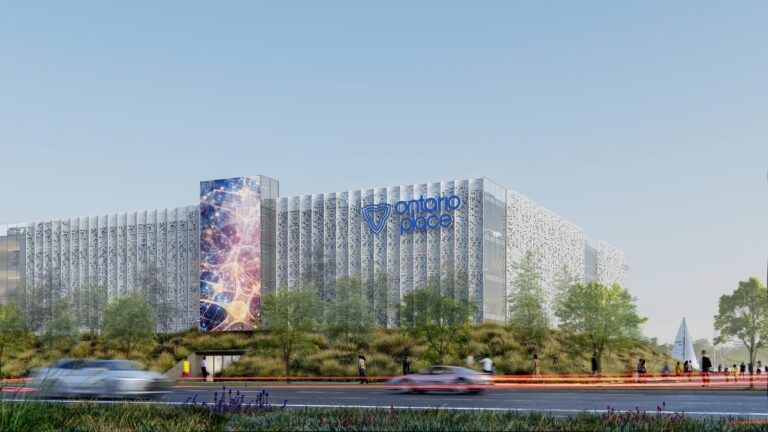

Featured image: Housing Aerial (CNW Group/Canada Infrastructure Bank)