Value-based decision-making supports TransLink’s vision.

By Llewellyn Fonseca

Asset management is common in asset intensive industries, such as utilities, mining, oil and gas, municipalities, and mass-transit; and is now well-recognized globally as part of standard engineering and business practices. Successful organizations that have institutionalized asset management ensure that their assets provide maximum value to the organization and their stakeholders.

The decision-making process for optimizing the value from investments requires a careful balancing act, especially at the political level where one must balance requests from constituents for new “shiny” projects and services with ensuring that existing customers and services are not neglected. Asset management provides a well-articulated and documented justification to ensure that the desired levels of service are maintained. Additionally, asset management provides assurance that the organizations’ assets will fulfill their intended functionality throughout their lifecycles at an acceptable level of risk.

The Metro Vancouver region contends with a growing population—over one million new residents are expected by the year 2050—aging assets and infrastructure, climate change, technological advances, and questions around sustainable funding sources. Our leaders and elected officials will need to continue making hard decisions and weighing trade-offs. Technical requirements, supported by asset management and renewal analysis, ensure that levels of service are maintained, but service expansion identifies the investment requirements for additional vehicles, infrastructure and resources to meet forecasted service increases. Structured value-based decision-making provides clear guidance in alignment with the overall strategy and vision.

TransLink, along with its operating companies and subsidiaries Coast Mountain Bus Company, British Columbia Rapid Transit Company Ltd. (SkyTrain), West Coast Express Ltd. and Metro Vancouver Transit Police, is financially responsible for managing an integrated regional transit network, including roads and bridges. TransLink continues to provide value to our customers through a great customer experience, including increased services that are safe, reliable and convenient, technological advances that improve services, and information that is accurate, timely and accessible. However, record-breaking ridership year-over-year (leading up to the pandemic), combined with substantial planned network growth for mass-transit light-rail services and staff retirement requires proactive and regular structured decision-making for investment planning and prioritization.

Stewardship of assets

TransLink’s Corporate Asset Management Strategy (CAMS) program was established to foster proactive asset management and build cross-enterprise partnerships to best support the organizational vision and ensure customer-focused, value-based investment decisions. The objective of the program is to effectively and efficiently deliver our corporate priorities to ensure enterprise-wide stewardship of our assets.

The initial focus of the asset management program was to build momentum, education, and a common understanding of the enterprise-wide asset management initiative within TransLink. By leveraging readily available data and information, the intent was to collaborate and sustain a cross-enterprise partnership and provide our senior leadership with visibility and confidence in our organization’s asset management capabilities.

One of our most successful initiatives has been our decision-support tool (DST) framework, which is used to support investment planning and prioritization by consistently evaluating a broad range of capital project requests on an annual basis. As a public agency committed to our customers, maximum value is achieved when our projects and programs align with the organizational vision and strategies. This vision includes definition of our corporate priorities, core business drivers or expectations of a transportation agency, organizational risk tolerance, and the levels of service expected by our customers.

As an example of optimizing the value from capital projects, major projects and public commitments (such as a new operations and maintenance center) or projects that are part of our corporate priorities and core business (like the replacement of customer-facing escalators) would provide multiple benefits and higher enterprise value, justifying their priority for funding. Additionally, the DST framework assesses the overall maturity and total enterprise-wide benefits of a proposed project. This implies that projects with a poorly defined scope, schedule or budget, or those pending the completion of a business case to justify the requested funds should be deferred or reconsidered later in the year.

Getting buy-in from stakeholders

With multiple competing interests for the same pot of limited capital funds, TransLink established an objective scoring criterion to evaluate and prioritize capital funding requests on a consistent basis. In alignment with asset management best practices, the scoring criteria were determined by the key drivers for business value across the organization. The DST framework is a strategic level objective framework that provides a transparent and structured means to identify the enterprise-wide business value of all projects and programs that are submitted as part of the annual capital planning process.

The framework examines how well the underlying business case for the project addresses the agency’s strategy and policy initiatives, the impact on the customer experience, business effectiveness, safety and security, environmental and financial responsibility, and other factors. Through the development of this process, TransLink has determined/ established/ confirmed/ prioritized strong alignment of corporate goals, buy-in and support across the enterprise, justification for changes to prior processes, and the importance of engaged stakeholders.

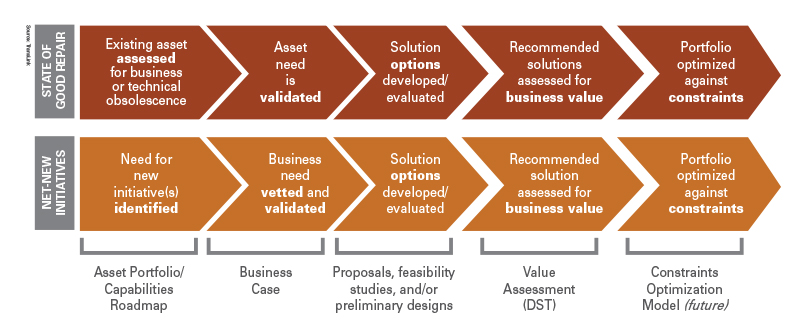

The DST (see figure above) is intended to help inform a broader investment planning process where needs are identified and validated by the specific operating company and subsidiary, solution options are developed and justified in a business case/feasibility study/assessment, and preferred solutions are assessed for overall business value (i.e. where DST is used).

After value assessment (DST), preferred solutions are then prioritized/optimized on a portfolio basis taking into account key organizational constraints, such as budget availability, human resources, operational impacts, project interdependencies and so forth. The reason for the split between value assessment and portfolio optimization is to provide our senior leadership with an opportunity to change the constraints. For example, if there is a resource constraint, they can recommend the hiring of more employees or contracting the service out. Alternatively, they could recommend moving forward with projects that have a lower organizational value but are still important to a specific operating company or subsidiary.

As with the implementation of any new business process, the key challenge was ensuring constant and consistent communication about the rationale behind the DST framework. During the first few years of using the DST framework, all stakeholders involved in the capital planning process needed to be reminded of the following:

- The DST assessed enterprise-wide value; hence a project that may be important to a specific stakeholder group does not automatically mean higher value.

- The DST valuation is a prioritized list of capital solutions assessed for business value; hence it is not recommended to define a ‘cut-off’ line for the list of capital projects.

Asset investment planning and enterprise portfolio decisions need to support decision-making based on the total lifecycle of the assets (i.e. optimizing capital and operating expenditures, performance and risk) and across different time horizons. Consider the following scenarios that may apply to any organization:

- A batch of vehicles are scheduled for replacement only in at least another couple of years; however, the number of unplanned maintenance issues are increasing, resulting in lower overall performance of the asset. This implies that it may be cost effective and of higher value to replace the vehicles this year instead of waiting another year.

- A production facility that has a scheduled roof and HVAC system replacement within two or three years of one another. Again, the value of combining the two projects and undertaking the work as at the same time is cost effective and efficient, leading to a higher enterprise value.

- As noted in the graphic, any net-new business initiatives or projects that are aligned to an organization’s overall strategic goals would also influence their enterprise value. Examples could include an organizational priority to utilize renewable energy to support operations, or leveraging technological advances to support business process improvements.

The main benefit of implementing the DST framework within the capital planning process is the support provided to senior leadership for structured decision-making. With the entire capital program assessed for business value, the conversations and debate between our decision-makers has shifted to understanding the benefits of the capital solutions versus just the importance and urgency of individual projects; especially for projects that did not score high within the DST value assessment. Additionally, the benefit of using a structured and consistent framework to justify our capital program has become even more apparent during these uncertain times, when “business as usual” has been disrupted, but the strategic vision and purpose of the organization has remained the same—providing essential public service to the Metro Vancouver region.

Value based decision-making

Asset management is a multidisciplinary approach that is valuable and relevant to employees across the organization – it is not just for engineers or maintenance personnel. Executive leadership needs to be confident in justifying their investment recommendations. Financial and procurement officers need to be transparent and consistent with their decision-making and reporting. Planning, design, engineering, maintenance, operations and project management staff need to understand and rationalize their projects for capital investments. Finally, asset managers need to support the organization with long-range strategic planning and prioritization of investments.

Value-based assessment of capital projects integrates the long-term requirements of an organization with the short-term business priorities across the entire lifecycle of the organizational portfolio to ensure consistent decision-making.

Llewellyn Fonseca, MBA, P.Eng. (non-practising) is senior manager, corporate asset management, project management office, with TransLink.