The Seventh Annual CRUX Insight Report, Changing the Narrative, reveals the scale of disruption and financial damage done to engineering and construction projects globally and the clusters of interrelated causes driving claims and disputes. One of these “mega-disrupters” – stemming from lack of skills and experience – is endemic, costing the U.S. and Canadian construction industries millions of dollars in lost time and money.

Key findings from the latest CRUX analysis include:

- 2,002 projects across 107 countries analyzed with a total value of $2.254 trillion

- Disputed costs averaged $83.1 million – just under a third (33.2%) of capital expenditure

- Time overruns would add almost 16 months or two-thirds (66.5%) to a typical schedule

- The total value of sums in dispute on the projects analyzed was $84.44 billion, while the cumulative length of time extensions was close to a millennium (994 years).

- Five “mega-disrupters” – conflicts and disputes over contracts, behaviors, speed to build, skills and the environment – each affected 40-50% of the projects worldwide.

- In the US and Canada, the skills-related mega-disrupter caused claims and disputes on over half (52.1%) of projects

- Workmanship deficiencies triggered claims and disputes on two out of every ten projects in the US and Canada (20.8%)

“CRUX Insight is a powerful lens that brings into sharper focus the risks facing infrastructure and capital projects. In the US and Canada, we generally manage many of these risk factors more effectively than in other regions, but we face particular challenges around skills and experience that demand a concerted response from owners, contractors, professional bodies, unions and other stakeholders,” said Maged Abdelsayed, partner, Construction Claims and Expert Services Lead, Americas, HKA.

“There is also much more we can do – from ensuring that designs are mature pre-construction to integrating teams more effectively to encourage positive behaviors. This year’s report shares valuable insights into how our industry can achieve better project outcomes.”

The findings of the Seventh Annual CRUX Insight report cover projects in 107 countries with a combined capital expenditure (CapEx) value of US$2.254 trillion. These projects faced overruns that would, collectively, approach a millennium (994 years) and total costs claimed in disputes of $84.44 billion.

On average, globally, projects claimed extensions of time to prolong works by an additional two-thirds (66.5%) of their planned schedules, while disputed costs averaged nearly a third of budgeted CapEx (33.2%).

While CRUX demonstrates variations in the pattern of claims and disputes between regions and project types, the analysis also confirms that the same deep-rooted problems recur across the years, sectors and borders.

These mega-disrupters each affected 40-50% of the 2,002 projects worldwide in the CRUX analysis, with regional variations:

- Contract: Conflicts over the formation or terms of a contract – from administrative shortcomings to spurious claims and tender errors – affected 43.2% of projects worldwide, rising to 51.9% in the Middle East and 68.0% in Africa. While cost inflation may have eased, economic shocks continue reverberating through long-term projects. Under financial pressure, contract administrators may resort to alternative ways of recovering costs, leading to clashes over the interpretation of clauses, alleged variations, and unsubstantiated claims.

- Behaviors: Half of all projects worldwide (49.7%) had claims and disputes related to individual and team behaviors that permeate every aspect of the construction process. Causes heavily influenced by behaviors peaked at 67.3% in the Middle East and hovered around 60% in Africa, Asia, and Oceania. The averages for Europe and the Americas were closer to 40%. Monetary pressures drive unreasonable behaviors, as do ingrained ways of working, especially in an unfamiliar context – whether a country, project type, or form of contract.

- Speed to build: Affecting 47.6% of all projects worldwide, this design-centric cluster (covering late, incomplete or incorrect design as well as late subcontractor/supplier appointments and unrealistic targets) is driven in large part by the twin imperatives to ‘speed the build’ and save on up-front time and costs. Rushing or overlapping design development with construction in the hope of achieving the earliest possible completion inevitably leads to more design changes, delays, and disputes as projects progress.

- Skills: Just under half of all projects (49.7%) worldwide had claims and disputes largely attributable to gaps in skillsets and experience. Aging workforces, lack of investment in human capital, and failure to attract young talent are contributory factors. The effects are evident from design offices to operational performance on site – and particularly noticeable in Europe (57.8%) and the Americas (51.5%), which suffered from higher levels of poor workmanship. In the UK, such defects were a factor in 26.0% of claims or disputes, compared to 14.8% worldwide.

- Environment: Exceptionally adverse weather was to blame for a relatively small proportion of claims and disputes, peaking at 13.3% in the Americas. But other factors with a strong environmental element (such as unforeseen ground conditions) pushed the total to 41.3% worldwide. More projects were impacted in Africa (56.0%), the Middle East (49.0%) and Asia (48.4%). Just as ominous for the industry, diverse environmental risks – from failure to design for resilience and emerging contaminants to concerns over corporate governance and biodiversity – are driving claims and litigation amid increasing scrutiny and regulation.

US and Canada outperform the rest of the world – but skill levels remain a disruptive issue

The CRUX analysis covered 606 projects across the United States and Canada, with a combined CapEx of $353 billion. Based on the global averages, projects in the Americas performed better than their counterparts in several respects.

The average cost claimed in the US and Canada was 31.3% of budgeted CapEx value, while the average extension of time (EOT) sought was 56.5% of planned duration – in both cases lower than the global benchmarks: (33.2% of budget) and (66.5% of schedule). Also, there was a tighter grip on change in scope – the top driver of claims and disputes globally – which affected 21.7% of projects in the Americas, opening up a 15-point gap with the rest of the world.

However, in the US and Canada, issues relating to skills – ranging from a shortage of workers to poor reporting, operational performance or interface management – caused claims and disputes in over half (52.1%) of all projects. This was almost 10% higher than the next biggest mega-disrupter in the region, environmental causes (42.9%), and above speed to build (42.7%), behaviors (41.4%), and contract issues (38.1%).

Workmanship deficiencies (such as welds or finishes that do not conform with contractual, statutory or accepted standards) are a significant element of this skills-centric cluster. It was associated with claims and disputes on 20.8% of projects in the US and Canada – compared with 16.2% in the rest of the world.

Similarly, operational performance – where an installation does not meet the requirements set out by the employer or in the design, say for energy performance – was a factor in 14.0% of project claims and disputes in the US and Canada, but only 11% outside of North America.

Installation failures causing loss, damage or injury – such as sprinklers not working in a fire – were also more common than in the rest of the world, affecting 12.9% of US and Canadian projects, compared with 7.6% elsewhere.

Dysfunctional model

There are many disparate causes of skills shortages, some less tractable or widely recognized than others. Dysfunctional strategies for managing human resources are one by-product of the industry’s highly competitive, low-margin operating model, which cannot sustain training and development. Firms struggle to attract and retain sufficient talent. Returns are low and risks high, deterring external investors. Labor productivity in construction has stagnated for decades, recently falling in Canada to a 30-year low. In the US, 41% of the pre-2020 construction workforce is due to retire by 2031.

Technology can alleviate some of the staffing pressures and boost productivity. Building Information Modelling (BIM) speeds up processes and can eliminate design clashes and other problems. Adoption rates are increasing, but contractors lag behind architects, and many are still uneducated in the use of BIM. There is also a risk of over-reliance on software solutions for design as well as scheduling and project management, so that users assume no further checks and verification are required. An understanding of ways of working on site and the role of physical drawings is still required.

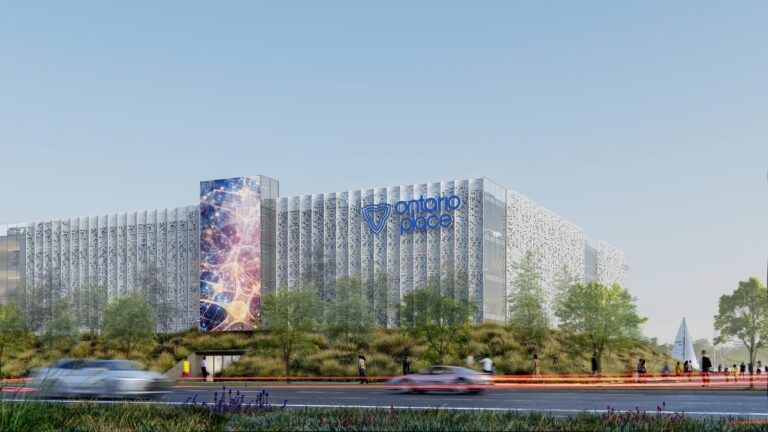

Featured image: (WDBA)