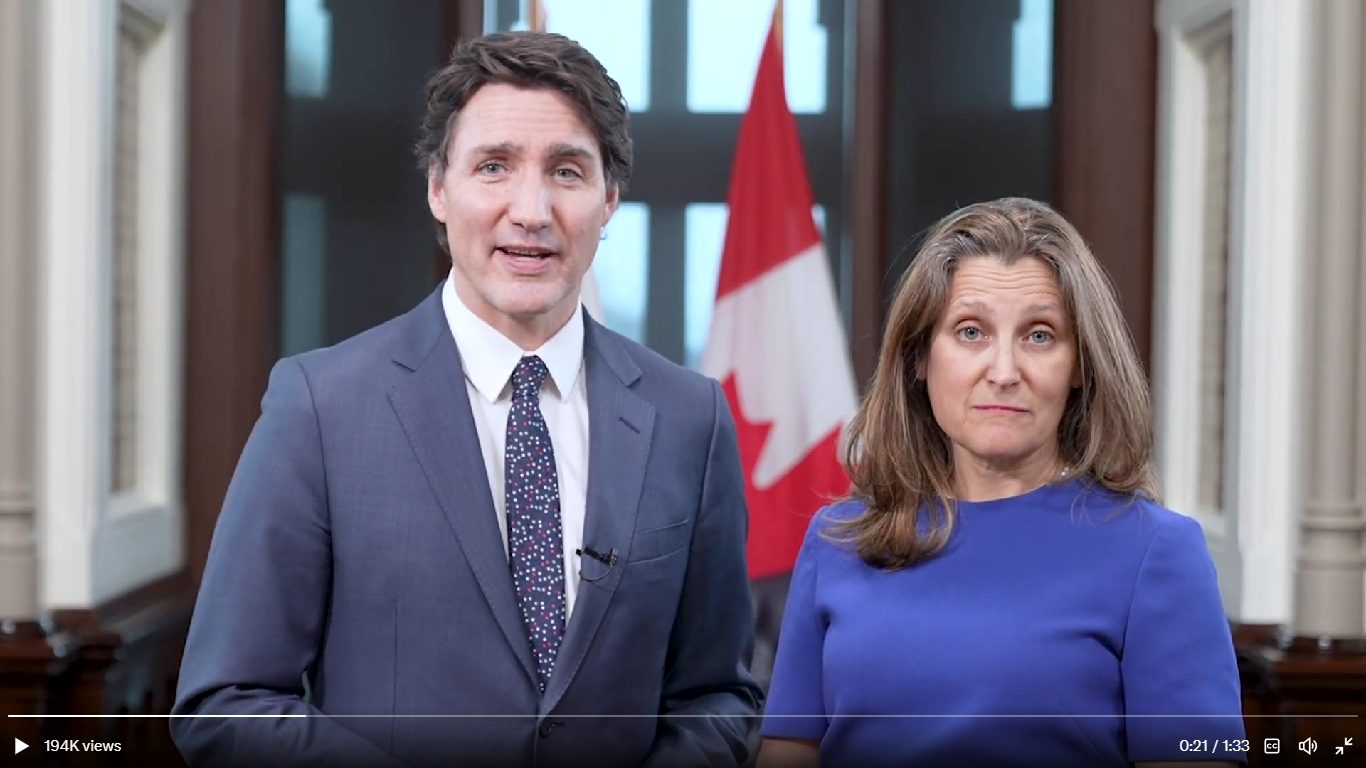

Chrystia Freeland, Minister of Finance unveiled the federal budget that included a focus on supporting clean electricity projects, with an assist from the Canada Infrastructure Bank and tax credits.

“To reach our goal of achieving net-zero emissions by 2050—and to power our homes, vehicles, and industries for generations to come—Budget 2023 puts in place major, long-term investments to place Canada on a track to build a net-zero emissions economy and secure Canada’s affordable clean electricity advantage,” stated the budget.

-

Beyond the clean electricity investment tax credit, as needed, low-cost and abundant financing through a targeted focus on clean electricity from the Canada Infrastructure Bank; and,

-

Targeted electricity programs, where needed, to ensure critical projects get built.

Budget 2023 also positions the Canada Infrastructure Bank to play a leading role in electrifying Canada’s economy, supporting lower energy bills for Canadians and businesses, and ensuring that cleaner, affordable electricity is available from coast to coast to coast.

Budget 2023 also proposes to provide $3 billion over 13 years to:

-

Recapitalize funding for the Smart Renewables and Electrification Pathways Program to support critical regional priorities and Indigenous-led projects;

-

Renew the Smart Grid program to continue grid innovation support; and,

-

Create new investments in science-based activities to help capitalize on Canada’s offshore wind potential, particularly off the coasts of Nova Scotia and Newfoundland and Labrador.

“The choice to pursue investment tax credits for clean technology, like wind, solar, storage and green hydrogen, will allow Canada to take a competitive lead in accelerating the decarbonization of the energy sector,” said Evan Wilson, senior director of policy and government affairs at the Canadian Renewable Energy Association (CanREA).

According to the budget, Building Canada’s clean economy will require significant and sustained private sector investment in clean electricity, critical minerals, and other major projects. Ensuring the timely completion of these projects is essential. In Budget 2023, the government is proposing further steps to ensure Canada’s reviews of major projects are fit for purpose to meet clean growth objectives while continuing to uphold the highest standards for environmental and other impacts.

“The government needs to create a more supportive environment to alleviate the labour choke points that risk crippling Canada’s economic growth,” says Mary Van Buren, President of the Canadian Construction Association (CCA). “This includes changing an outdated immigration point system and working with provinces to ensure better skills matching.”