According to a report released by Procore Technologies, Inc. and the Associated General Contractors of America, 70 per cent of Canadian civil and infrastructure construction firms expect their project backlog to increase or remain the same over the next year as new federal infrastructure funding ramps up.

The report, Top Civil & Infrastructure Trends: Today’s Industry Challenges and Opportunities, found that many firms are worried that labour shortages and productivity challenges could undermine their success with these projects.

“With increased backlogs prompted by once-in-a-generation government investment in the U.S. and Canada, civil and infrastructure organizations are on the cusp of seeing a tremendous growth in projects,” said Nolan Frazier, regional sales director, Canada at Procore. “Canadian firms need to implement innovative solutions in order to prepare for these massive undertakings, while also navigating challenges such as the ongoing labour shortage and the cost of materials.”

The new report, which is based on a survey of nearly 500 general and specialty contractors in Canada and the U.S., explores how civil and infrastructure organizations are building today, the challenges they face, and the opportunities that lie ahead. The construction association and Procore conducted the survey to measure the potential impacts of hundreds of billions in new federal infrastructure investments on the construction industry.

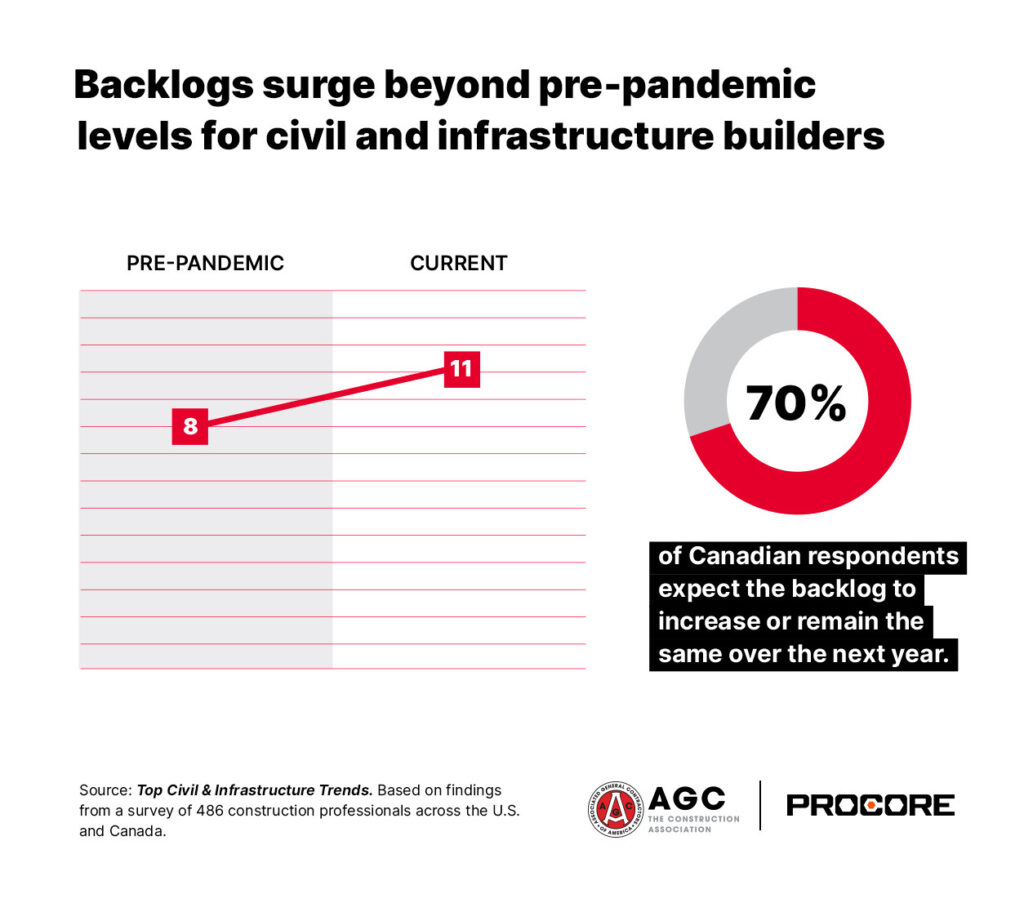

Canadian civil and infrastructure builders report an average increase of 38 per cent in their backlogs – projects they are contracted to complete but have not yet started – since the COVID-19 pandemic. And 70 per cent of firms in Canada expect that backlog to grow or remain level during the next twelve months.

However, roughly three in ten of civil and infrastructure projects fail to meet their specified budget, schedule, and quality goals, leaving important opportunities for improvement in project outcomes, according to the survey.

Respondents identified the factors having the greatest impact on the success of projects, including material and labour costs (45 per cent); project management (45 per cent); and communication within the organization (39 per cent). Additionally, factors such as timely responses to requests for information/changes (38 per cent) and workflow efficiency (38 per cent) rounded out the top five most impactful factors.

Many Canadian civil construction firms report they are investing in software and technology to help overcome some of their key challenges. Fifty-one per cent indicate they’re implementing solutions that help identify, track, predict and correct quality and safety issues. Fifty per cent report they are using data and analytics tools to better predict risks. Forty-six per cent report they are using planning and estimating software to ensure greater accuracy in their project pricing. Additionally, 45 per cent say they are adopting technology solutions that improve financial visibility and cost control on projects.

When adopting new technology for civil and infrastructure projects, one-third of Canadian respondents (33 per cent) noted the top barrier or challenge was the lack of integration across solutions.

Firms are also changing the way they get involved in projects to ensure they are successful. Fifty-eight per cent are involved in some stage of the design. Thirty-eight per cent of Canadian respondents report they get involved at the capital design or conceptual planning phases of projects.

Featured image: Gordie Howe International Bridge project. (WDBA)